M&A—Understanding the Dynamics for Buyers and Sellers

M&A activity, within the CASE and specialty chemicals markets, continues at a very high level. Today, this is especially true in North America. In a large part this activity level is driven by the strength of the US economy over the last few years. During the same period, shifts in the global economy have resulted in the increased importance for greater participation (or in establishing a presence) in the North American market by offshore companies.

For Europe, the slowing of the European economy along with shifts in manufacturing infrastructure from the EU into the Asia Pacific region have elevated the value of offshore expansion. In the case of Asia Pacific companies that have little or no sales into North America (in particular, into the US) they see sales growth into this region as an important strategic revenue growth opportunity. While the current trade tariff confrontations have caused concerns and some retrenchment in M&A plans directed at the US market, the trend-line for the next few years still appears favorable.

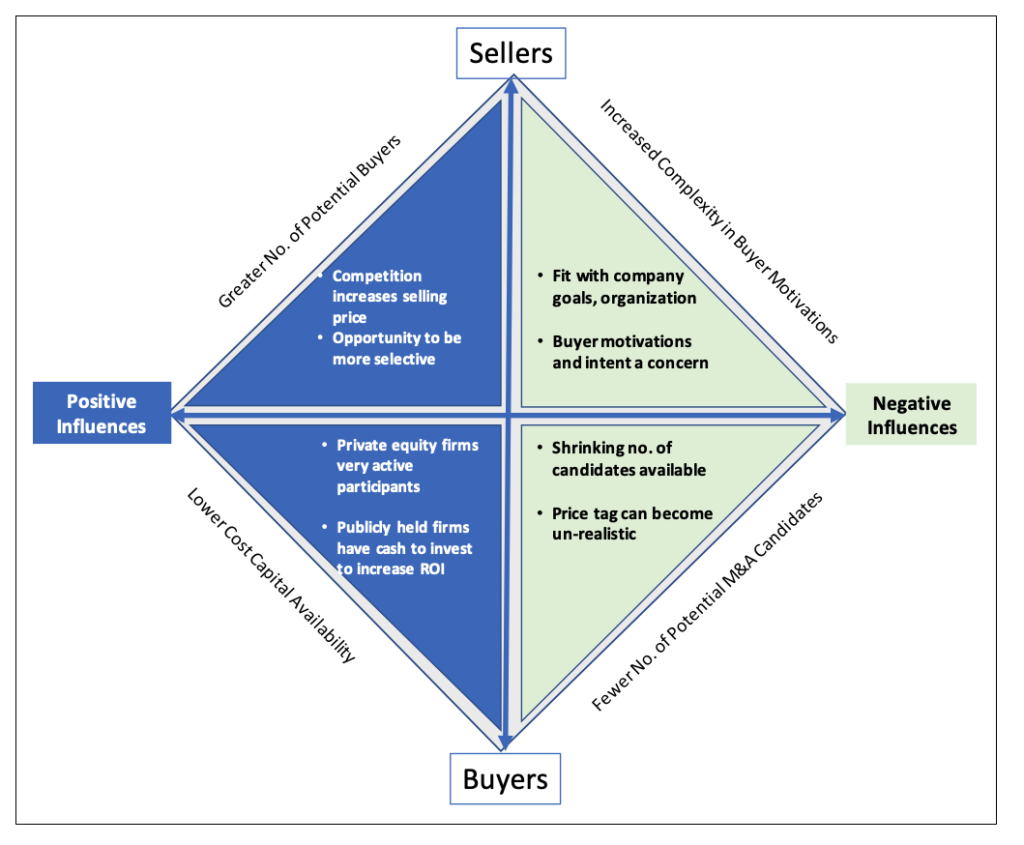

In today’s marketplace, companies interested in selling their business or organization looking to divest, benefit from a very active business climate. The number of potential buyers continues to be very large. This results in a very competitive business environment pushing the expected selling price for a given business upward. It also creates the opportunity for sellers to be more selective in their choice of potential buyers. In the case of privately-owned firms, this normally includes the willingness of buyers to address specific issues such as retention of personnel, compensation, and continuance of brand identity. Red flags are frequently raised for sellers when the traditional fabric of the organization and any of the above business issues are not being addressed adequately by perspective buyers.

The following illustration provides an overview of key market dynamics at play in the field of mergers and acquisitions. In general, M&A market dynamics, for both buyers and seller, includes both positive and negative factors that together comprise the challenges as well as the opportunities that exist in this process.

Buyer categories include private equity firms, publicly traded organizations, and entrepreneurs/independent investors. In all these cases, the availability of low-cost capital or cash provides the engine for a very active M&A market climate.

Today, the number of potential candidate companies has shrunk and continues to get smaller especially in the mid-sized company range. In addition, competition among buyers for these remaining candidate companies has push-up the price tag to a level that sometimes creates a marginal or unrealistic return on invested capital (ROI).

Private equity firms are typically focused on identifying companies that have a niche’, well defined market position or novel technology that will benefit from an infusion of capital. This may be through the addition of resources or other capital investments that jump-start of stimulate revenue growth. As a general rule private equity firms want to enter businesses that are positioned (within their product life cycle) either as embryonic or considered as operating in the growth side of the life cycle curve. Ultimately, the objective of private equity firms is to reap the value of their investments in the business by exiting it at a future date.

As buyers, corporations, privately owned businesses, or entrepreneurs/independent investors most often target acquiring companies that compliment and/or expand their business position. M&A intent varies but includes one or more of these business objectives: (a) Increase of market share or geographic market reach; (b)addition of complimentary products that strengthen the current market position; (c) grow revenues and improve cash flow from current operations making the company more competitive; (d) expand or improve channel-to-market positioning.

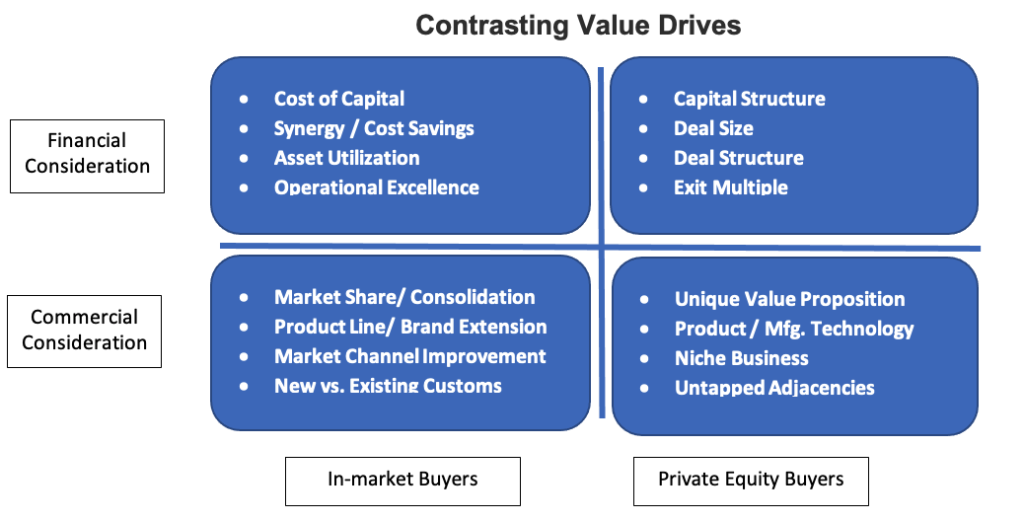

Overall, the M&A drivers vary (and often significantly) between private equity firms and in-market buyers whether corporations, privately owned businesses, or entrepreneurs. With the large number of perspective buyers participating today, seller preparation and planning becomes extremely important. This is not only to maximize their return on the sales of the business. It is also because of possible negative impacts that might occur during the process of selling the business. Preparation and planning are also important in order to anticipate and address unwanted consequences that may result from its sale. This is especially true for medium to smaller sized companies that are privately owned.

Table 1: Seller Considerations

- Manage Information Flow//Maintain Confidentiality

During the M&A process managing information flow and follow-up is key. Most important, detailed information regarding the business, including financial details, need to be exchanged. Protection of this information is critical to the future success of the company.

- Identifying buyer priorities, needs and addressing their concerns

The methodologies used during the M&A process to achieve a successful result are founded on providing a forum within which buyers can communicate their priorities and the specific needs that can be achieved through acquisition of the company. Just as important is the identification of key concerns and the efforts put forth to address and resolve these issues.

- Clearly define personal and business priorities and articulate the desired outcomes

Each owner or public company has specific business priorities and desired outcome goals for the sales of the business. For privately owned company’s personal goals and outcomes are especially important. This includes concerns for the existing employees who often are long-time company contributors. It is also tied to the reputation and brand identities that has been established over an extended period of time. How these issues are dealt with during the M&A process, is important in cultivating the best candidate buyers. It is also important in avoiding misunderstandings that might arise later in the process.

In dealing with the above issues, intermediaries (advisors/consultants) in the M&A process have a definite value. Intermediary companies provide a buffer between the buyer and seller. Keeping the process outside of the company also insulates employees from these activities avoiding unwanted internal repercussions. Employing an intermediate also facilities dialogue from both sides that assists in addressing specific concerns or business issues that can be resolved through understanding and/or compromise.