Patrick Jones

Vice President, Strategic Alternatives

Contributing Editor

This month’s Business Corner is the final installment of our three-part series discussing topics related to mergers and acquisitions. In this column we will revisit some of the highlights from parts one and two and tie them together with additional commentary and suggested strategic and tactical considerations.

The Current Investment Environment

Following the Great Recession, interest rates have remained at or near historical lows while private investors and publicly traded multinationals have amassed unprecedented levels of investable cash. The private owners of these $trillions need to deploy their reserves into higher risk, alternative investments such as Private Equity to meet their yield requirements. Similarly, cash-rich publicly held corporations are under pressure to deliver acceptable levels of return on capital in the face of an uneven global economy where GDP growth rates struggle to sustain 3% in the best economies. Yes, China’s GDP is reportedly in the 6% to 7% range, but the trajectory is downward and many of its basic industries are plagued with overcapacity. So, with organic growth increasingly difficult to attain, many publicly traded corporations are looking at stock buy-back programs and/or acquisitions to drive higher shareholder returns.

The net results of the convergence of these needs are reflected in the following trends:

- Increased competition for M&A transactions;

- Cheap debt lowers the overall cost of capital for companies with strong balance sheets;

- Resulting transaction values and EBITDA multiples have increased, creating a seller’s market;

- Convergence of buyer behavior among Strategic Buyers, Private Equity and Family Offices is evident in the market.

Similar Fundamental Need; Different Value Drivers

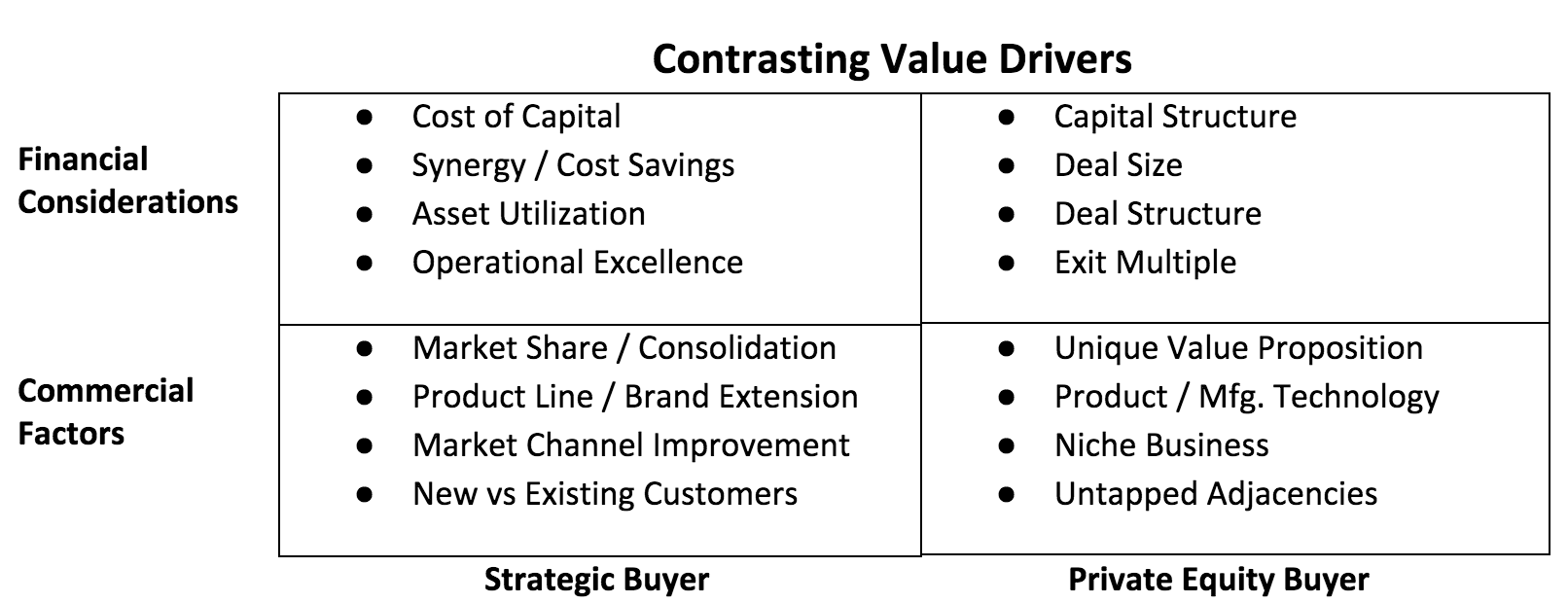

In part two of this series, we used some basic comparative financial analysis to demonstrate that, although Strategic Buyers and Private Equity have similar needs to deliver the returns expected by investors, these two classes of buyer must treat potential deals differently and they, therefore, have different value drivers.

Strategic Buyers, generally speaking, acquire companies with either a cost-driven or a market-driven thought process. These companies tend to have strong senses of identity and understand how to create value by leveraging their approach to business. They typically are seeking to solidify an existing market position, improve access to customers / distribution channels, round out a strategic product line, increase plant loading, and/or add margin at little incremental variable cost. Buying market share (consolidation) grows the buyer’s business even if the underlying market is stagnant.

When establishing a new business platform, Private Equity is typically looking for companies that have a niche position and/or some sort of product or manufacturing uniqueness with the potential for broader application/utilization. The target might be a family-owned company with no clear succession plan, or it could be an orphan product line or “carve out” from a larger corporation seeking to prune its portfolio. The PE buyer wants to invest to capture the upside growth potential that can be unlocked by adding resources (human and capital) and modifying the fundamental way in which the company sees and sets overall business strategy. And, if all goes according to plan, after a reasonable hold period the PE will one day seek to monetize its investment by exiting the business to a new owner.

Seller Considerations

With cheap capital, increased competition for deals and the resulting increase in valuations in recent times, what should potential sellers of private companies do to maximize their potential?

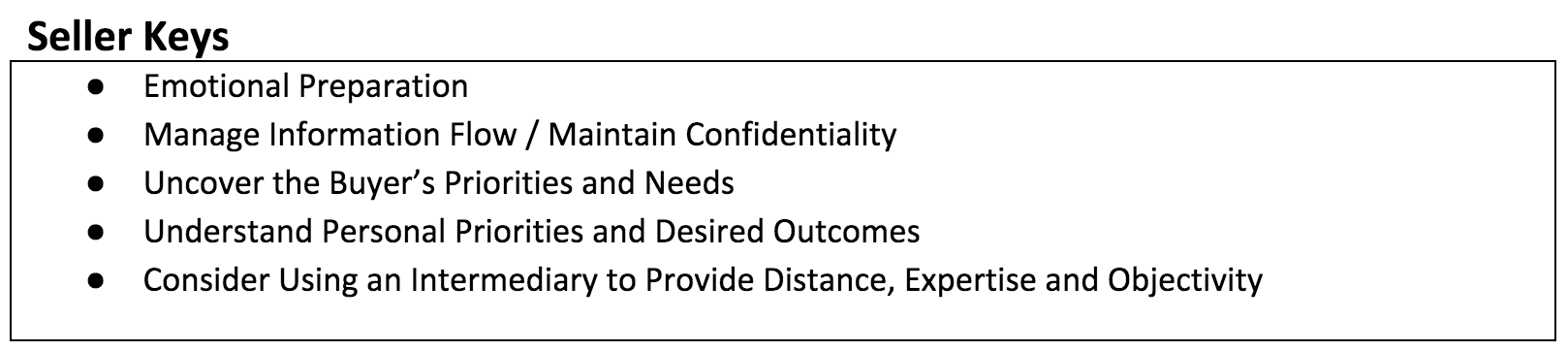

First, and this may seem obvious, as they teach in the boy scouts: be prepared. The owner who is considering selling needs to prepare himself/herself mentally to go through the process of selling. Being ready to sell does not mean simply being of retirement age or having a long bucket list. We often see owners genuinely struggle with the emotional aspects of making a major life change such as selling their company or exiting their life’s work. For many, even those that say they are most ready, the separation anxiety is akin to the grieving process one experiences after the death of a loved one or the end of a long relationship.

In addition to managing the potential inner turmoil, the seller has to be able to work with the prospective buyer(s) to support the necessary due diligence process all buyers must complete in advance of closing the transaction. The seller must become comfortable (if not comfortable then at least accepting) sharing detailed, confidential information with strangers. Answering detailed (perhaps invasive) questions as the buyer works toward achieving the necessary comfort level to make the investment is a critical part of the process. Patience is indeed a virtue here.

The need to share sensitive data raises the issue of internal confidentiality. Who is going to be involved and in the communication loop with the buyer? This also can raise questions related to succession plan expectations, retention of key non-shareholder members of Management, and overall workforce continuity. Managing who, when and how plans to sell are communicated to the employees is a critical element in securing on-going support for the new owners. In many cases, purchase agreements will contain earn out or hold back provisions making partial payment of the purchase price contingent upon future performance of the business. Missteps can be very costly to both parties.

Understand the priorities and hierarchy of needs on the buy side of the table. As noted in this series of articles, not all buyers will view the business through the same lens, and smart sellers understand how to use the discrepancy to their advantage. Ask probing questions of the buyer to develop a clear understanding of his/her strategic intent and determine where your company fits their needs. Armed with the feedback, what can you do as a seller to maximize your fit with buyer value drivers?

Finally, sellers need to have a clear understanding of their personal priorities and desired outcomes before entering into a negotiation or a selling process. Everyone knows a fantastic anecdote about “that company” that was bought/sold at that incredible EBITDA multiple, but do not fall into the trap of thinking every asset trades at the top of the market and your company is the next record setter. In all likelihood there will be unavoidable trade-offs raised in the negotiation process, and both sides want to steer the conversation in their direction. Prevent being caught off guard and manage the emotions at the table or in the moment of proposal/counterproposal by spending some time anticipating and prioritizing the inherent compromises with specific deal points. Be realistic and set aside your rose-colored glasses if possible.

Because the selling process is imprecise and fraught with emotion, many owners will elect to engage third party support, consultants and/or investment bankers, to manage the process. Intermediaries are a key element of many types of transactions as sellers and buyers benefit from the emotional distance that is created as well as the technical inputs from an objective outsider who brings specific transaction or industry expertise and insight. This approach can expedite matters and pay great dividends.

Conclusion

Over the past three installments of the Business Corner, we have touched on a wide array of topics and concepts associated with buying and selling companies. We have discussed the tendencies and reputations of different buyer types and attempted to link those generalizations to real business needs. In doing so, we have examined quantitative considerations and demonstrated the basics of how transactions are modeled, and we have analyzed the qualitative concerns of buyer and seller and suggested some tactical considerations for managing the negotiation process. This series is by no means intended to be an exhaustive treatment of the subject of M&A, but hopefully it was a good conversation starter. We at CHEMARK hope that you have found this series to be informative, thought-provoking, and perhaps a bit entertaining.